Return on Assets Calculator

Want to gauge your company’s asset performance? Our free ROA Calculator reveals how effectively your assets generate profits. Perfect for CFOs, investors, and analysts. Just input net income and total assets—get your ROA ratio instantly. Get smarter financial decisions.

What is Return On Assets ( ROA )?

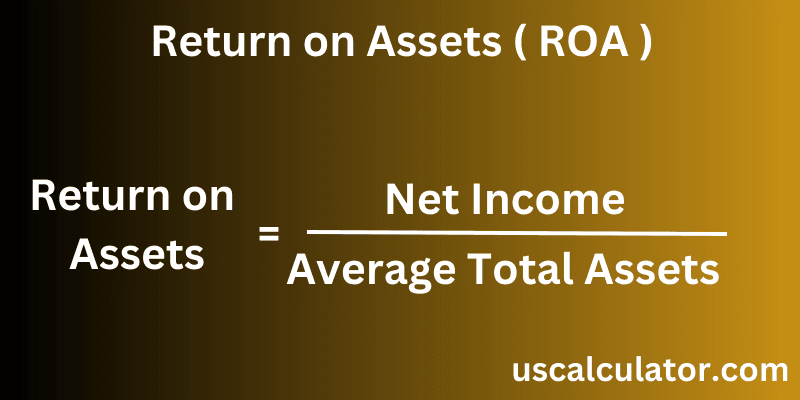

Return on Assets Calculation Formula

correct the calculation example for the Return on Assets (ROA) ratio.

The correct formula for Return on Assets is -

ROA=Average Total AssetsNet Income

Return on Assets calculation example

example for clarification:

1.Understand Financial Information -

Total Assets at the end of the year: $ 3,000,000

Total Assets at the beginning of the year: $ 1,000,000

Net Income: $ 500,000

2 . Calculate Average Total Assets - Average Total Assets=2

Beginning Total Assets+End Total Assets

Average Total Assets=2$1,000,000+$3,000,000=$ 2,000,0003 . Add in the Numbers into the Formula - ROA=Average Total AssetsNet Income

ROA=$2,000,000$500,0004 . Perform the Calculation - ROA=0.25

5 . Explanation of the Result - The ROA ratio is 0.25 or 25%.