Break-Even Calculator

Launching a business or product? Our free Break-Even Calculator reveals exactly when you’ll start making money. Just input Fixed Costs, Cost Per Unit, and Revenue Per Unit, and get instant clarity on your profit timeline. Perfect for startups, entrepreneurs, and savvy planners.

About Break-Even Calculation

On this page, we understand what the break-even point is. How do we calculate it? What is its formula? We know the concept with examples. So the first thing that comes to mind is: What is the break-even point? The break-even point is also called the break-even level. The break-even point is above which our sales and total costs are equal. It means neither we make a profit nor do we incur a loss. It means we have recovered as much as we have spent. But we are neither making a profit nor making a loss. Those are the points. Now the question arises: does it mean sales are similar to total costs?

The total cost is our variable cost plus our fixed cost. Now, what is a fixed cost? Like any rent, machinery, or whatever expenditure you have incurred on it, your fixed cost. And after that, what is the variable cost? You brought some raw materials, some labor charges, and electricity bills—all these are variable costs. So if we add the variable and the fixed cost, we get our total cost. And when our sales recover the total cost, we call that point a break-even point. Now we come to the question: how do we calculate the break-even point? The formula for the break-even point is fixed cost divided by the CM ratio and multiplied by 100.

Now, what is the CM ratio? For our CM ratio, we need to find CM. Now, how will we find CM? We will subtract the variable cost from the sales. The answer that comes will be our CM. The answer for CM will be divided by the total sales and multiplied by 100. So, the ratio that comes will be called the CM ratio.

Now, how do we find the break-even point? We divide the total fixed cost by the CM ratio and multiply it by 100. So, the answer that comes is our break-even point. That means we come to know from that answer that if we make this many sales, then whatever our back cost, our expenditure, and of course that expenditure is fixed or variable, both the expenses will be recovered. This tells us this: I hope you know its concept.

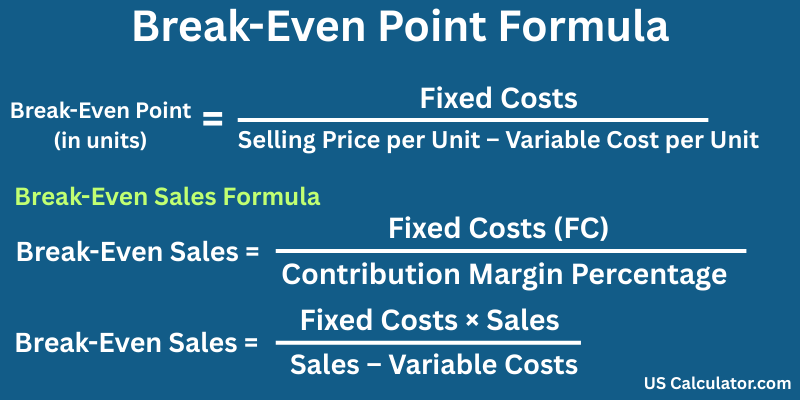

Break-Even Calculation Formula

The Break-Even Point is calculated using the following formula –

Break-Even Point (in units) = Fixed Costs / (Selling Price per Unit – Variable Cost per Unit)

Break-Even Calculation Example

For example, if your fixed costs amount to $ 10,000, the selling price per unit is $ 20, and the variable cost per unit is $ 10, the Break-Even Point in units would be:

Break-Even Point = $10,000 / ($20 – $10) = 1,000 units

Use our Break-Even Calculator to get a thorough financial and strategic planning analysis.

Moving on to more intricate estimations is simple. We utilize our useful break-even calculator to figure the number of units, revenue, margin, and markup using the calculations provided.

References for Business Calculation Units:

1. U.S. Small Business Administration (SBA) – Financial Calculations and Tools

Source: U.S. Small Business Administration

Reference:

Offers resources on calculating startup costs, break-even points, cash flow, and profit margins.

Link: https://www.sba.gov/business-guide/plan-your-business/calculate-your-startup-costs

2. Investopedia – Business and Financial Calculations

Source: Investopedia

Reference:

Offers resources on calculating startup costs, break-even points, cash flow, and profit margins.

Link: https://www.sba.gov/business-guide/plan-your-business/calculate-your-startup-costs